Building Tomorrow's

Digital Solutions

We craft exceptional software solutions that transform businesses and drive innovation in the digital landscape.

Core Services

Comprehensive technology solutions tailored to your business needs

Software Development

Custom applications and systems built with cutting-edge technologies

ICT Solutions

Comprehensive information and communication technology infrastructure

Internet Solutions

Advanced web-based platforms and digital experiences

Excellence in Every Project

We combine technical expertise with innovative thinking to deliver solutions that exceed expectations and drive real business value.

Technical Excellence

Cutting-edge technologies and best practices

Agile Development

Flexible and iterative approach to project delivery

24/7 Support

Round-the-clock assistance and maintenance

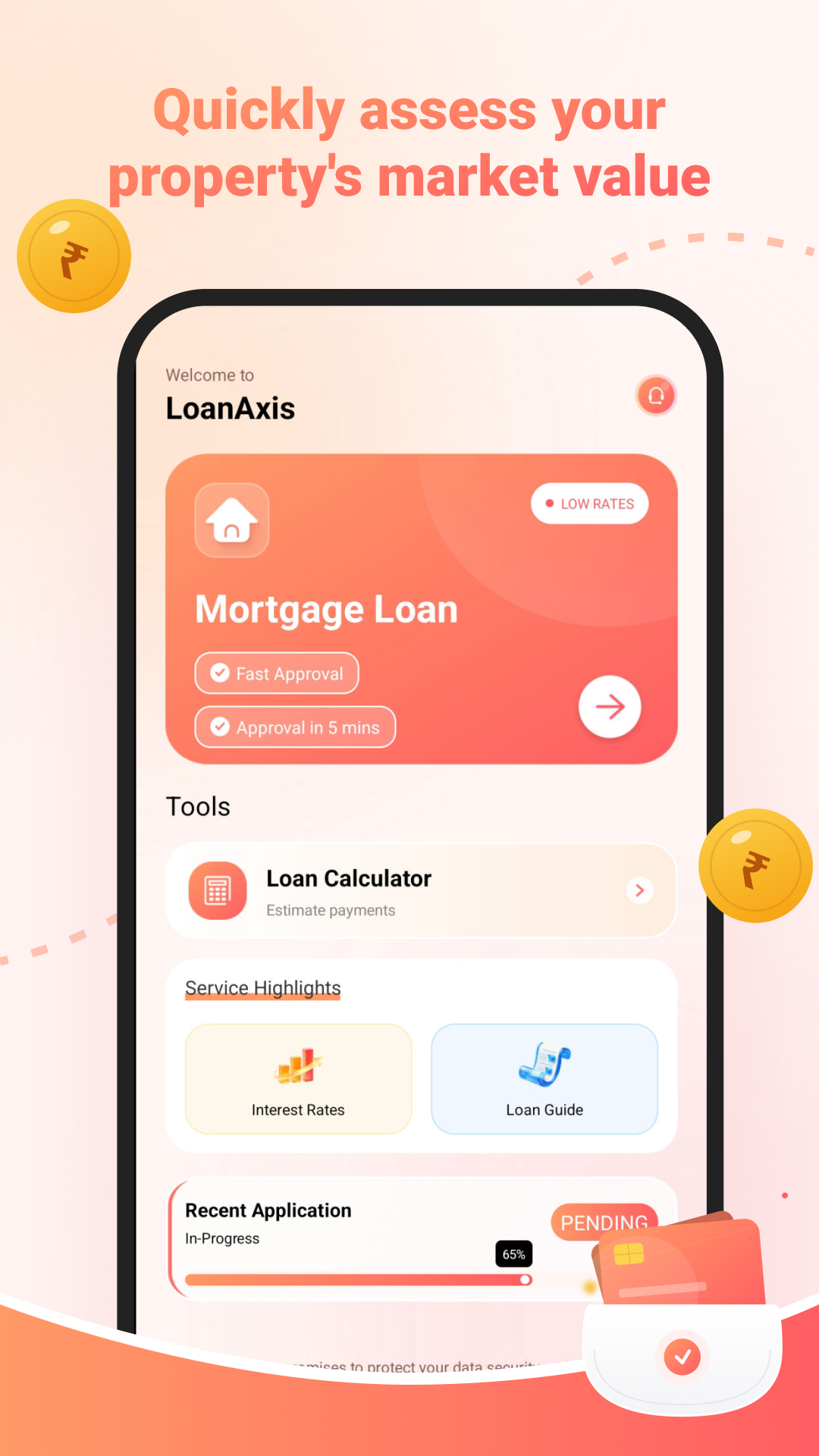

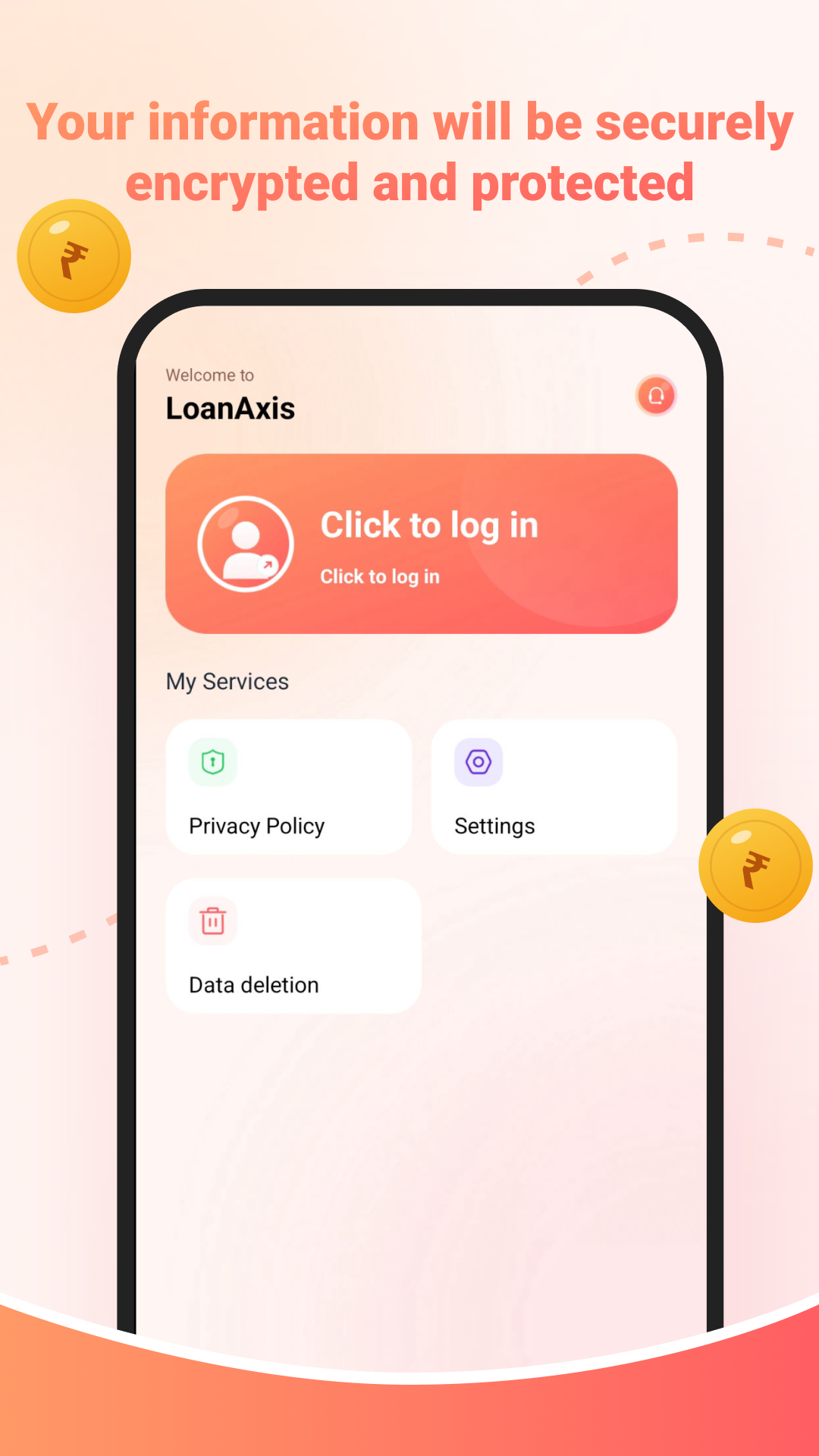

LoanAxis-Special Funds

A secure, convenient, and efficient mortgage service platform.

LoanAxis is a financial service application focused on real estate-related mortgage loan scenarios. It provides clear and standardized loan assessment and information matching services for users who own real estate or related assets. By submitting necessary property information, users can more efficiently understand the mortgage loan options available to them, providing reference support for financial planning.

Within LoanAxis, users can fill in information based on their own property ownership details (such as property type, location, ownership status, etc.). The platform will combine this information with the product rules of compliant financial institutions to provide corresponding loan plan guidance, helping users reduce communication costs and improve application efficiency.

Product Features:

Smart Loan Matching

Matches loan amounts based on user's property information, increasing approval rates

Multi-Institutional Cooperation

Partners with banks, NBFC, and other institutions, ensuring diverse funding sources

Transparent and Compliant

Clearly displays loan information, with no hidden fees

Simplified Process

Convenient online document submission

Data Security

Prioritizes user privacy and information protection

Mortgage Amount

- Loan Amount: INR 100,000 - 50,000,000

- Annual Interest Rate (APR): Not exceeding 18% per annum.

- Loan Term: Minimum 91 days, maximum 365 days.

Repayment Calculation Example: A loan of INR 10,000 with a term of 120 days (4 months) has an annual interest rate of 18% per annum (daily rate of 0.05%). There are no other additional fees. After 120 days, the user's total repayment amount = principal + total interest. The breakdown is as follows:

- Monthly Interest: 10,000 x 0.05% x 30 = 150 Indian Rupees

- Monthly Repayment: 10,000/4 + 150 = 2,650 Indian Rupees

- Total Interest: 150 x 4 = 600 Indian Rupees

- Total Repayment: 10,000 + 600 = 10,600 Indian Rupees

The specific loan amount is subject to approval based on the submitted documents. LoanAxis does not guarantee loan approval for every user; the actual approval result is subject to change.

Application Requirements

- Age Requirement: Must be 18 years of age or older and have full civil capacity.

- Identity Requirement: Must hold valid Indian identity documents.

- Credit Requirement: Must meet the basic lending requirements of relevant financial institutions.

- Eligibility Requirements: Property ownership certificate and other documents are required.

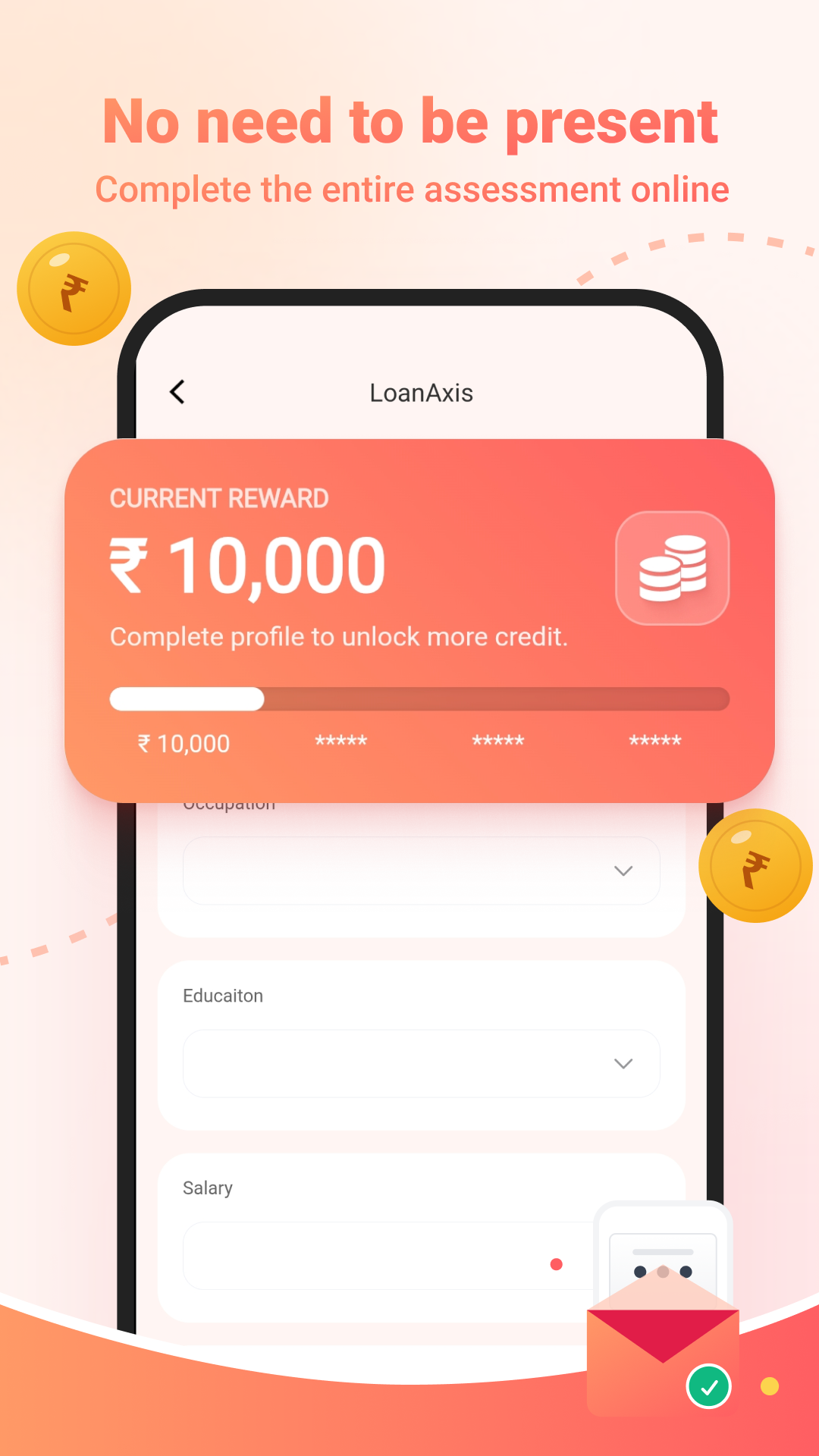

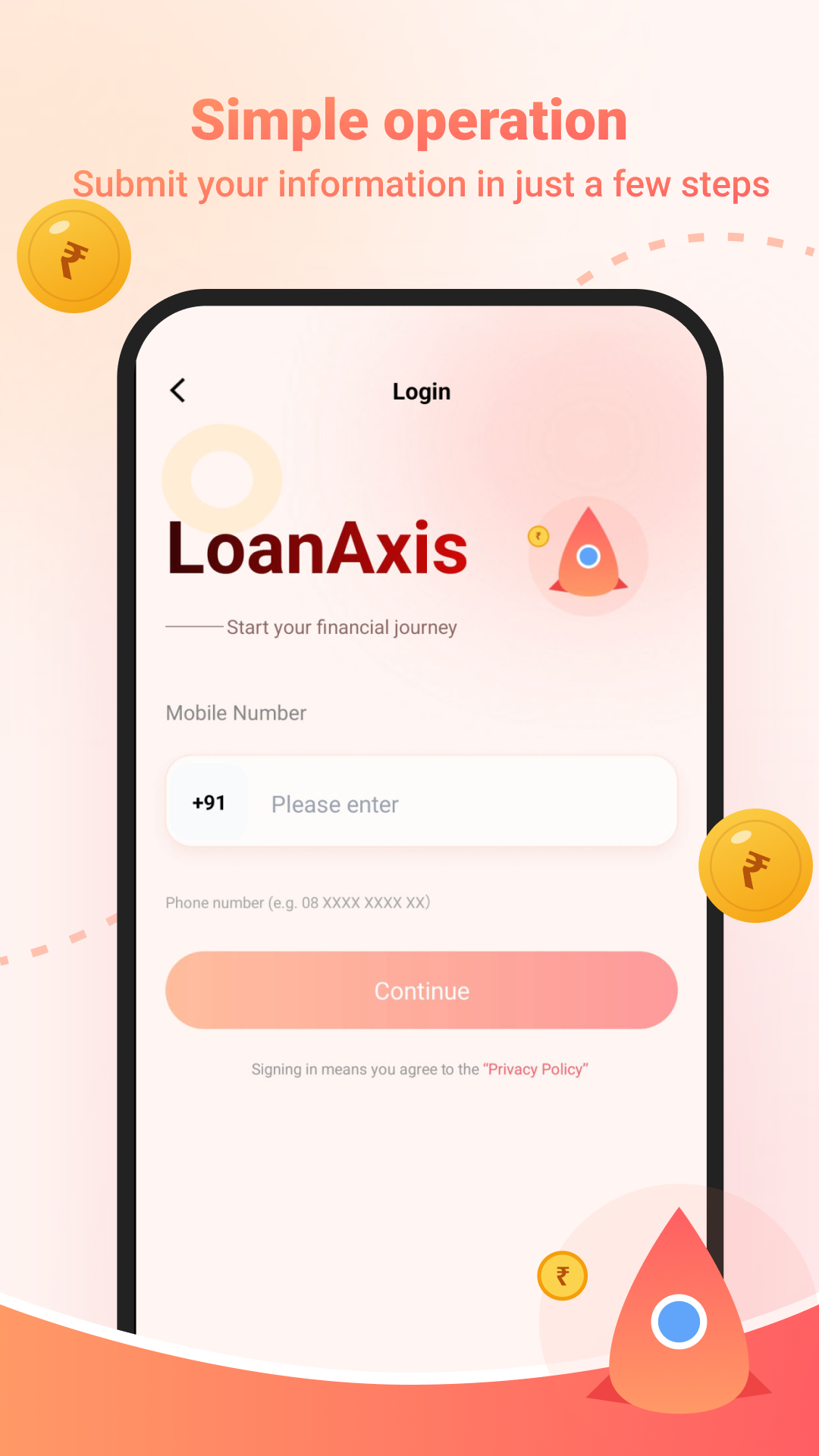

Loan Application Process

- Download and install LoanAxis

- Register an account and fill in basic information

- Authorize necessary data permissions

- The system recommends suitable loan products

- Select a product and submit your application

- The cooperating financial institution reviews and disburses the loan.

Contact Us

- Email: news@mahamayasoft.com

- Working Hours: Monday to Sunday 09:00-18:00

- Address: FLAT NO. 202, MEENAKSHI APARTMENTS 9, VIDHYA NAGAR, BHAWARK UHA INDORE, Madhya Pradesh, India - 452001

Ready to Build Something Amazing?

Let's discuss your project and explore how we can bring your vision to life.